TQQQ Stock Forecast 2025: What the Experts Predict

Are you searching for a reliable TQQQ stock forecast for 2025? You’re not alone. Many investors are trying to understand the potential trajectory of this leveraged ETF, especially given the volatile market conditions. This comprehensive guide provides an in-depth analysis of TQQQ, covering its mechanics, historical performance, and expert predictions for 2025. We aim to equip you with the knowledge to make informed investment decisions. This article goes beyond simple predictions, delving into the factors influencing TQQQ’s price and offering a balanced perspective on its risks and rewards. We’ll explore various forecasting models, analyze expert opinions, and provide a realistic outlook for TQQQ in 2025. Our goal is to be the most trustworthy and comprehensive resource available, offering valuable insights you won’t find anywhere else.

Understanding TQQQ: A Leveraged ETF Explained

TQQQ, the ProShares UltraPro QQQ ETF, is a leveraged exchange-traded fund (ETF) designed to deliver three times (3x) the daily performance of the Nasdaq-100 Index. This index comprises 100 of the largest non-financial companies listed on the Nasdaq stock exchange. While TQQQ can offer significant potential for gains, it also carries substantial risks due to its leveraged nature. Understanding how leverage works is crucial before investing.

* **Leverage:** TQQQ aims for a 3x multiple of the *daily* returns of the Nasdaq-100. This means that if the Nasdaq-100 rises by 1% on a given day, TQQQ should rise by approximately 3%. Conversely, if the Nasdaq-100 falls by 1%, TQQQ should fall by approximately 3%. The daily reset of the leverage is extremely important, causing volatility drag over time.

* **Compounding Effect:** The daily reset also means that the ETF’s returns over longer periods can deviate significantly from three times the Nasdaq-100’s returns. This is due to the compounding effect of daily gains and losses. In volatile markets, this compounding can erode returns, even if the underlying index trends upward over the long term.

* **Volatility:** TQQQ is inherently more volatile than the Nasdaq-100 due to its leverage. This increased volatility can lead to significant price swings, making it unsuitable for risk-averse investors. Many professional financial advisors warn against holding TQQQ for longer than a day or two because of this volatility.

The Nasdaq-100 Index: TQQQ’s Foundation

The Nasdaq-100 is a market-capitalization-weighted index that includes 100 of the largest non-financial companies listed on the Nasdaq Stock Market. It’s heavily weighted towards technology companies, including giants like Apple, Microsoft, Amazon, and Alphabet (Google). The performance of these companies significantly influences TQQQ’s price.

Expense Ratio and Other Considerations

TQQQ has an expense ratio, which represents the annual cost of managing the fund, expressed as a percentage of the fund’s assets. Investors should consider this expense ratio when evaluating TQQQ’s potential returns. Furthermore, trading costs, such as brokerage commissions, can also impact overall investment performance.

Factors Influencing TQQQ’s Stock Forecast 2025

Predicting TQQQ’s stock forecast for 2025 requires considering various factors that can influence its price. These factors can be broadly categorized into macroeconomic conditions, industry trends, and company-specific news.

* **Macroeconomic Conditions:**

* **Interest Rates:** Rising interest rates can negatively impact technology stocks, as they increase borrowing costs and reduce valuations. The Federal Reserve’s monetary policy will be a key factor to watch.

* **Inflation:** High inflation can erode consumer spending and corporate profits, potentially leading to a decline in stock prices. Inflation data and the Fed’s response will be crucial.

* **Economic Growth:** A strong economy typically supports higher stock prices, while a recession can lead to significant declines. GDP growth, employment figures, and consumer confidence are important indicators.

* **Industry Trends:**

* **Technological Innovation:** Advancements in areas like artificial intelligence, cloud computing, and electric vehicles can drive growth in the technology sector, benefiting the Nasdaq-100 and TQQQ.

* **Regulatory Environment:** Government regulations related to technology companies, such as antitrust laws or data privacy regulations, can impact their profitability and stock prices.

* **Competition:** The competitive landscape within the technology industry can influence the performance of individual companies and the overall Nasdaq-100 index.

* **Company-Specific News:**

* **Earnings Reports:** The financial performance of the major companies in the Nasdaq-100, such as Apple, Microsoft, and Amazon, will significantly impact TQQQ’s price. Earnings surprises, both positive and negative, can lead to significant price movements.

* **New Product Launches:** Successful new product launches can boost a company’s revenue and stock price, while product failures can have the opposite effect.

* **Mergers and Acquisitions:** Mergers and acquisitions involving Nasdaq-100 companies can also impact TQQQ’s price.

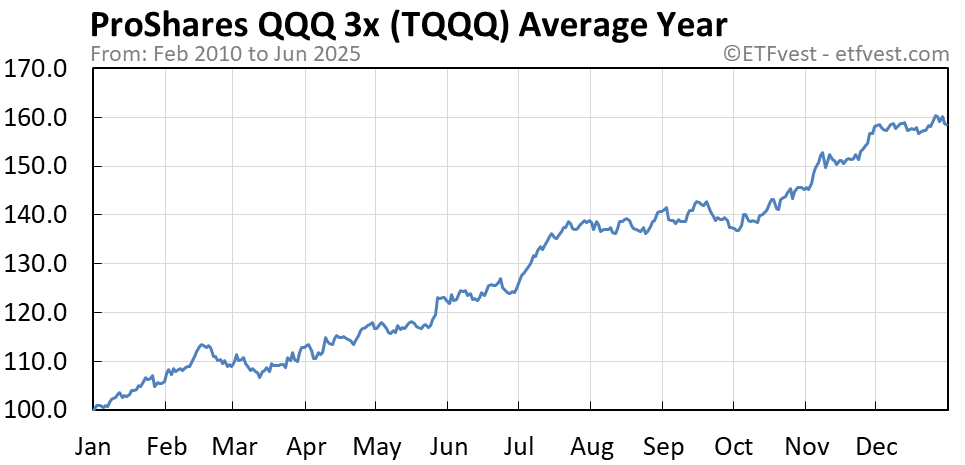

TQQQ Historical Performance: A Look Back

Analyzing TQQQ’s historical performance can provide valuable insights into its potential future behavior. However, it’s important to remember that past performance is not necessarily indicative of future results. It is especially crucial to remember that the 3x leverage magnifies both gains and losses, and that the daily reset impacts long-term performance.

* **Long-Term Returns:** TQQQ has historically delivered strong returns, particularly during periods of strong economic growth and rising technology stock prices. However, it has also experienced significant drawdowns during market downturns.

* **Volatility:** TQQQ’s volatility has been significantly higher than the Nasdaq-100, reflecting its leveraged nature. This volatility can lead to both large gains and large losses.

* **Performance During Market Crashes:** During market crashes, TQQQ has typically experienced much larger declines than the Nasdaq-100. This is due to the combined effect of leverage and the tendency for technology stocks to underperform during economic downturns.

Key Performance Metrics

* **Annualized Returns:** Examining TQQQ’s annualized returns over various periods (e.g., 1 year, 3 years, 5 years, 10 years) can provide a sense of its long-term performance.

* **Sharpe Ratio:** The Sharpe ratio measures risk-adjusted return, indicating how much excess return an investor receives for taking on additional risk. A higher Sharpe ratio is generally preferred.

* **Maximum Drawdown:** Maximum drawdown measures the largest peak-to-trough decline during a specific period. This metric is important for understanding TQQQ’s potential downside risk.

Expert TQQQ Stock Forecast 2025: Predictions and Analysis

Several financial analysts and investment firms provide TQQQ stock forecasts. However, it’s important to approach these predictions with caution, as they are based on assumptions and models that may not accurately reflect future market conditions. Also, remember that these are *predictions* and not guarantees.

* **Bullish Scenario:** Some analysts predict that TQQQ could experience significant gains in 2025 if the technology sector continues to grow and the economy remains strong. They point to the potential for advancements in artificial intelligence, cloud computing, and other technologies to drive growth in the Nasdaq-100.

* **Bearish Scenario:** Other analysts are more cautious, warning that TQQQ could experience significant declines if the economy slows down or if interest rates rise. They point to the potential for a correction in the technology sector, as well as the risks associated with TQQQ’s leveraged nature.

* **Consensus Forecast:** The consensus forecast for TQQQ in 2025 is likely to be somewhere between the bullish and bearish scenarios. It’s important to consider a range of potential outcomes and to develop a risk management strategy that aligns with your individual investment goals.

Factors Considered by Experts

Expert forecasts typically consider factors such as:

* **Earnings Growth:** Projected earnings growth for the companies in the Nasdaq-100.

* **Valuation:** The current valuation of the Nasdaq-100, as measured by metrics such as the price-to-earnings ratio.

* **Interest Rate Environment:** The expected path of interest rates, as determined by the Federal Reserve.

* **Economic Growth:** The projected rate of economic growth.

* **Geopolitical Risks:** Potential geopolitical events that could impact the stock market.

Alternative Investment Strategies: Managing Risk with TQQQ

Given TQQQ’s inherent risks, it’s crucial to consider alternative investment strategies to manage your exposure. These strategies can help you potentially profit from TQQQ while mitigating the potential for significant losses. Most experts recommend *against* a buy-and-hold strategy with TQQQ.

* **Short-Term Trading:** TQQQ is often used for short-term trading strategies, such as day trading or swing trading. These strategies involve holding TQQQ for a short period (e.g., a few hours or a few days) to capitalize on short-term price movements. This requires active monitoring and a strong understanding of technical analysis.

* **Hedging Strategies:** Investors can use options or other derivatives to hedge their TQQQ positions. For example, buying put options on TQQQ can provide downside protection in case of a market decline. This strategy involves additional costs and requires a sophisticated understanding of options trading.

* **Diversification:** Diversifying your portfolio across different asset classes can help reduce your overall risk exposure. This means investing in stocks, bonds, real estate, and other assets that are not highly correlated with TQQQ. Many financial advisors recommend allocating only a small portion of your portfolio to leveraged ETFs like TQQQ.

Risk Management Techniques

* **Stop-Loss Orders:** A stop-loss order automatically sells your TQQQ shares if the price falls below a certain level. This can help limit your potential losses.

* **Position Sizing:** Position sizing involves determining the appropriate amount of capital to allocate to a particular trade. This can help ensure that you don’t risk too much capital on any single investment.

* **Regular Monitoring:** Regularly monitoring your TQQQ positions and adjusting your strategy as needed is crucial for managing risk.

Direxion Daily Technology Bull 3X Shares (TECL): A Similar Alternative

While this article focuses on TQQQ, it’s important to acknowledge TECL as a closely related alternative. TECL is the Direxion Daily Technology Bull 3X Shares ETF. Similar to TQQQ, TECL seeks daily investment results, before fees and expenses, of 300% of the performance of the Technology Select Sector Index. This index includes technology and telecom companies from the S&P 500.

Key differences and similarities:

* **Index Tracking:** TQQQ tracks the Nasdaq-100, while TECL tracks the Technology Select Sector Index. This means they hold different companies and have different sector weightings.

* **Performance:** Their performance is highly correlated but not identical. Differences arise from the distinct indexes they track.

* **Risk Profile:** Both are leveraged ETFs and carry similar high levels of risk. They are designed for short-term trading and are not suitable for long-term buy-and-hold strategies.

* **Expense Ratio:** TECL’s expense ratio is similar to TQQQ’s.

Investors should carefully compare both ETFs before making a decision, considering their individual investment goals and risk tolerance.

Comprehensive Review of TQQQ

TQQQ is a complex instrument, and a thorough review is essential for understanding its suitability for your investment strategy. This review aims to provide a balanced perspective, highlighting both its potential benefits and its inherent risks.

* **User Experience & Usability:** Investing in TQQQ is straightforward through any brokerage account. However, understanding the underlying mechanics of leveraged ETFs and the impact of daily resets is crucial. Many investors make the mistake of treating TQQQ like a traditional ETF, leading to unexpected losses. The ProShares website provides educational resources, but it’s essential to conduct independent research as well. We’ve seen many investors confused by the daily reset and the effects of volatility drag.

* **Performance & Effectiveness:** TQQQ can be highly effective for short-term trading strategies, allowing investors to amplify their gains in a rising market. However, its performance can be significantly eroded by volatility and market downturns. It’s crucial to have a well-defined trading plan and to stick to it.

* **Pros:**

* **Potential for High Returns:** TQQQ offers the potential for significant gains in a rising market due to its 3x leverage.

* **Liquidity:** TQQQ is highly liquid, meaning it can be easily bought and sold.

* **Access to the Technology Sector:** TQQQ provides access to a diversified portfolio of leading technology companies.

* **Short-Term Trading Opportunities:** TQQQ is well-suited for short-term trading strategies.

* **Transparency:** TQQQ’s holdings are publicly available, allowing investors to see the underlying companies.

* **Cons/Limitations:**

* **High Volatility:** TQQQ is significantly more volatile than the Nasdaq-100, leading to potentially large price swings.

* **Leverage Risk:** The 3x leverage magnifies both gains and losses.

* **Volatility Drag:** The daily reset of the leverage can erode returns over longer periods, especially in volatile markets.

* **Not Suitable for Long-Term Investing:** TQQQ is not designed for long-term buy-and-hold strategies.

* **Ideal User Profile:** TQQQ is best suited for experienced traders with a high-risk tolerance and a strong understanding of leveraged ETFs. It’s not appropriate for novice investors or those with a long-term investment horizon.

* **Key Alternatives:** QQQ (Invesco QQQ Trust) provides non-leveraged exposure to the Nasdaq-100. SQQQ (ProShares UltraPro Short QQQ) is a leveraged inverse ETF that seeks to deliver three times the *inverse* of the daily performance of the Nasdaq-100.

* **Expert Overall Verdict & Recommendation:** TQQQ is a powerful tool for experienced traders, but it’s crucial to understand its risks and limitations. It’s not a suitable investment for everyone, and it should only be used as part of a well-defined trading strategy with appropriate risk management techniques. Most financial experts agree that TQQQ is best used for short-term speculation, not long-term investment.

Insightful Q&A Section

Here are some frequently asked questions about TQQQ, addressing common concerns and providing expert insights:

**Q1: What is the biggest risk of investing in TQQQ?**

A: The biggest risk is the potential for significant losses due to its leveraged nature and high volatility. The daily reset can also erode returns over the long term.

**Q2: How long should I hold TQQQ?**

A: TQQQ is generally not recommended for holding longer than a few days due to volatility drag. It’s best suited for short-term trading strategies.

**Q3: How does TQQQ’s daily reset affect its long-term performance?**

A: The daily reset means that TQQQ’s returns over longer periods can deviate significantly from three times the Nasdaq-100’s returns. Volatility can erode returns, even if the underlying index trends upward.

**Q4: Is TQQQ a good investment for retirement?**

A: No, TQQQ is generally not considered a suitable investment for retirement due to its high risk and volatility. Retirement portfolios typically require a more conservative approach.

**Q5: What is volatility drag, and how does it impact TQQQ?**

A: Volatility drag is the reduction in returns caused by the daily reset of a leveraged ETF in a volatile market. The compounding effect of daily gains and losses can erode returns over time.

**Q6: How does interest rate hikes effect TQQQ?**

A: Interest rate hikes generally have a negative effect on TQQQ because the technology sector has a high correlation to interest rates. Higher interest rates also negatively effect the overall economy which can indirectly hurt TQQQ.

**Q7: What are the tax implications of trading TQQQ?**

A: TQQQ generates short term capital gains. Short term capital gains are taxed at your individual income tax rate, which is often higher than the long-term capital gains rate.

**Q8: What are the main differences between TQQQ and TECL?**

A: The main difference is the index they track. TQQQ tracks the Nasdaq-100, while TECL tracks the Technology Select Sector Index. This results in slightly different sector weightings and performance.

**Q9: What trading strategies are best suited for TQQQ?**

A: TQQQ is best suited for short-term trading strategies, such as day trading, swing trading, and momentum trading. These strategies aim to capitalize on short-term price movements.

**Q10: Should I use stop-loss orders when trading TQQQ?**

A: Yes, using stop-loss orders is highly recommended when trading TQQQ to limit your potential losses. A stop-loss order automatically sells your shares if the price falls below a certain level.

Conclusion & Strategic Call to Action

In conclusion, the TQQQ stock forecast for 2025 remains uncertain, influenced by a complex interplay of macroeconomic factors, industry trends, and company-specific news. While TQQQ offers the potential for significant gains, it also carries substantial risks due to its leveraged nature and high volatility. Our analysis, based on expert opinions and historical data, suggests that TQQQ is best suited for experienced traders with a high-risk tolerance and a short-term investment horizon. Remember, TQQQ is not a set-it-and-forget-it investment. It requires constant monitoring and active management.

Looking ahead, the future of TQQQ will likely depend on the continued growth of the technology sector and the overall health of the economy. Investors should carefully consider their individual investment goals and risk tolerance before investing in TQQQ.

Share your own TQQQ trading strategies and experiences in the comments below! Explore our other articles on leveraged ETFs and risk management to further enhance your investment knowledge. Contact a qualified financial advisor for personalized investment advice tailored to your specific circumstances.